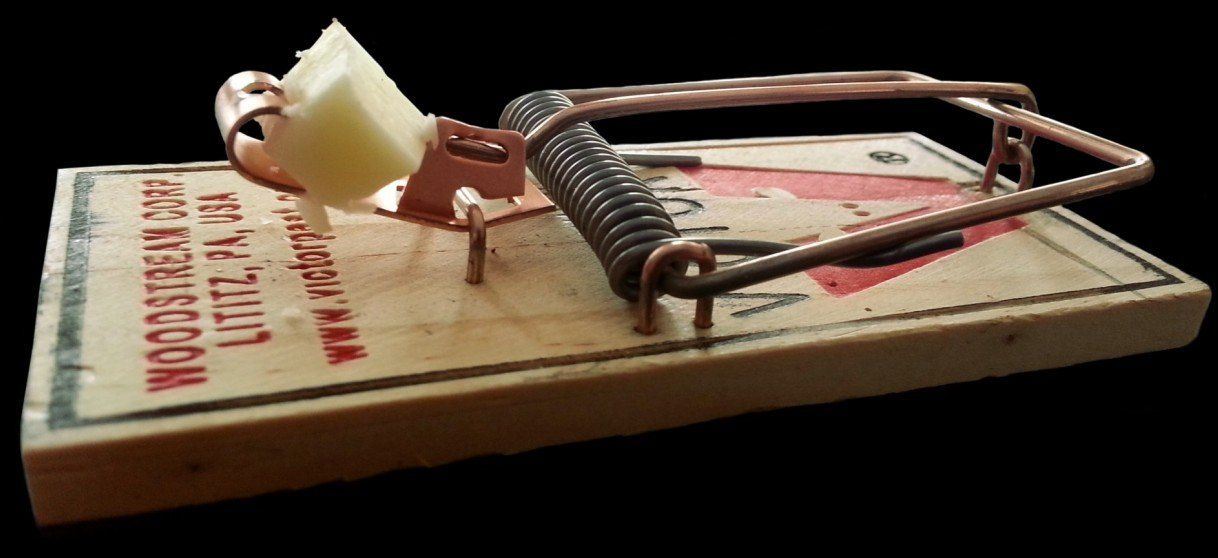

Refinancing traps to avoid

Whether you’re after lower repayments or want to tap into the equity sitting in your home, refinancing can offer significant benefits. Here are some things to be aware of so that you don’t find yourself hooked into a bad deal.

Don’t be fooled by the interest rate

Finding a lower interest rate doesn’t necessarily mean you’ve scored yourself a better deal. In fact, a product with more features may cost you a bit more in fees or interest, but could save you more in the long run. Including features such as an offset account will prove valuable as it will allow you to make larger repayments or put any extra cash against the loan. Products without this feature may charge a fee for early repayments.

Honeymoon rates are just that

Don’t be lured by offers with discounted introductory rates unless you’ve calculated the savings over the life of the loan. While a loan with a discounted interest rate seems a tempting offer, it’s only temporary. Once the introductory period is over, the interest will revert to a higher standard variable for the rest of the loan term. It may be more beneficial financially to negotiate a lower interest rate without an introductory discount.

Be aware of the fees

One of the main purposes of refinancing is to lighten the financial burden, however, that doesn’t mean that it’s not going to cost you. There are many fees involved, which may include discharge and application fees, a valuation fee, land registration fee, and mortgage insurance. You may also be subject to stamp duty depending on what state your property is located in. While these cannot be avoided, you have to ensure that the costs involved are not higher than the savings, to make the process worthwhile.

While there are traps to avoid, a little expertise can take the stress out of refinancing to save you thousands, fund that renovation, or simply find a loan that suits your life a little better. My Mortgage Professionals can guide you through the process.

Call us today on 0418 119 118. We're here to help.

This page provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. It does not constitute legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances. Subject to lenders terms and conditions, fees and charges and eligibility criteria apply.

enquiries@mymps.com.au

My Mortgage Professionals Pty Ltd

Credit Representative 494832 is authorised under Australian Credit Licence 389328

Your full financial situation will need to be reviewed prior to acceptance of any offer or product.

ABN 58 481 559 142